Key takeaways

- Prior to hiring new employees, businesses need to register with the CRA for a business number and payroll deduction program.

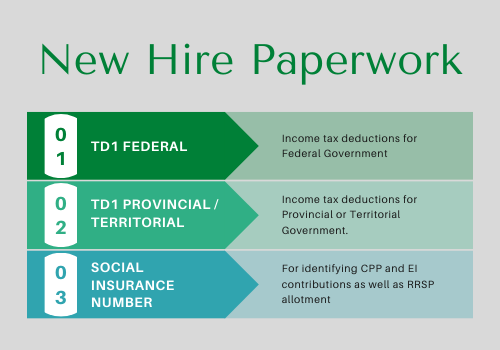

- Every new employee needs to complete a TD1 Form and provide their SIN.

- To avoid penalties, ensure that payroll deductions are accurate; pay all deductions to the CRA by the remittance due dates.

Professional Leadership Institute (PLI) is an educational website providing professionals from all types of businesses with practical education in human resources and leadership. To keep evolving your leadership toolkit, additional PLI resources below will be useful.

What is Canadian new hire paperwork?

New hire paperwork is the set of forms that employers must complete when hiring a new employee. In Canada, these forms include TD1 forms, Personal Tax Credits Return and the new employee’s SIN. Each employee will also need to complete a Federal Form TD1 and, depending on their place of residence, a Provincial or Territorial Form TD1.

Properly onboarding a new employee is critical in the employee’s journey with your company. The onboarding process is where the company makes its first impression. It is also a key tool in setting the employee’s experience with the company. Hiring managers and leaders should ensure that their company’s onboarding process is smooth and provides employees with all the necessary information to set them up for success.

When does new hire paperwork need to be completed?

HR and or hiring managers should have new employees fill out all necessary new hire forms on their first day at work. Service Canada allows employers up to three days after the new employee starts to report their Social Insurance Number (SIN). The Canadian Revenue Agency (CRA) allows employers up to seven days after the new employee starts to submit their TD1 Form. New hire paperwork must be completed within the new employee’s first month of employment. If new hires do not complete this paperwork in time they can face fines from Revenue Canada, which could lead to other issues such as missing out on government benefits or tax deductions. It is recommended that new employees fill these forms out right away for convenience and to avoid any penalties.

Getting set up – Things to do before hiring your first employee

As an employer, before hiring new employees, you will need to set up the following for reporting and remitting payroll deductions:

Business Number

This is a unique nine-digit reference number that you will use when working with the CRA to pay for GST/PST/HST, report and remit payroll deductions, etc. You can register online through the CRA’s website for a business number.

Payroll Deductions Account

This account is for remitting payroll deductions withheld from each employee’s paycheque. Businesses will need to apply for the program online through CRA’s website. Remitting payroll deductions late and or incorrectly can lead to penalties. Therefore, it is strongly recommended that businesses read and review all payroll deductions requirements and stay up to date with payments. When and where applicable, seek professional tax advice from an accountant.

TD1 Form, Personal Tax Credits Return, and other new hire paperwork

There are potentially 2 Form TD1 that each new employee must fill out: Federal and Provincial. The TD1 Form calculates the payroll deductions that the business withholds on every paycheque from the employee. Payroll deductions include:

- Personal Income tax

- Canadian Pension Plan

- Employment Insurance Premiums

Each new employee must complete their TD1 forms. It is the responsibility of the employer to withhold payroll deductions regardless of when the employee completes their TD1 forms. Employers are legally responsible for withholding the appropriate payroll deductions. Payroll administrators can use CRA’s Payroll Deductions Online Calculator to estimate the amount of deductions needed to withhold on behalf of an employee.

Additionally, depending on the situation, each employee’s TD1 form may be different. For example, if you are a student attending an accredited post-secondary institution school, you may have fewer payroll deductions due to tuition credits or benefits provided. Filling out your TD1 form with accurate and appropriate information will allow employers to withhold the correct amount based on the employee’s situation. The form does not need to be updated unless the employee’s situation changes.

Note: it is recommended that employees seek a personal tax accountant for any and all advice on personal taxes.

Social Insurance Number (SIN)

In Canada, the Social Insurance Number is a reference number that allows an individual to receive government benefits. Employers need to collect new employee’s SIN within three days of starting their new job. This should also keep the employee’s name and SIN on record.

Employers must verify employment authorizations for new employees with SIN that begin with “9.” This denotes a non-Canadian Citizen or a non-permanent resident who has employment authorization under a different status.

Voluntary Report on Hirings program

For businesses that conduct a significant amount of hiring throughout the year, you can opt to use the online Report on Hirings tool. This tool automatically reports new and recalled hires to Services Canada. This is done via a service gateway on a monthly basis.

New Employee’s Benefits

New hires can take advantage of new employee benefits. The most common new hire benefit is matching 401(k) plans that allow new employees to contribute a certain percentage of their paychecks towards retirement savings accounts, which they will not have access too until the age where they are legally permitted by law to withdraw from them and use the money for other purposes (usually around 59-60 years old). Other new hire benefits include health insurance packages or even gym memberships among others.

Check out our article on workplace compensation and benefits!