Technology has introduced many new ways, such as debit cards and mobile tap, for consumers to pay for goods. Despite these new convenient payment forms, cheques are still used and accepted at many businesses.

There are scenarios where writing a cheque is more convenient than other payment forms. For example, when the purchase amount is greater than your credit card limit, you may write a cheque to pay.

Certain businesses may not take credit card due to the large sums they process, and the transaction fees charged. For example, most post secondary institutions do not accept credit card as payment for tuition since the transaction fees would be exorbitant.

Before deciding to write a cheque for a payment, it is recommended that all other payment options be exhausted. Personal cheques can be very costly and are less secure than other payment forms. Other payment forms to explore before breaking out the cheque book include debit card, email bank transfer, or even a one-bank draft if you do not already have cheques readily available.

Basics of writing a cheque

When writing a cheque, there are a few simple things to keep in mind:

- Always use pen – black or blue ink is preferred

- Always ensure you have enough funds in your account for the amount of the cheque

- Never write a blank cheque or pre-sign your signature on a check

- Fill out all the sections of the cheque; missing sections leaves room for fraud

- If the cheque book does not come with carbon copies, always make a copy to keep for your own record

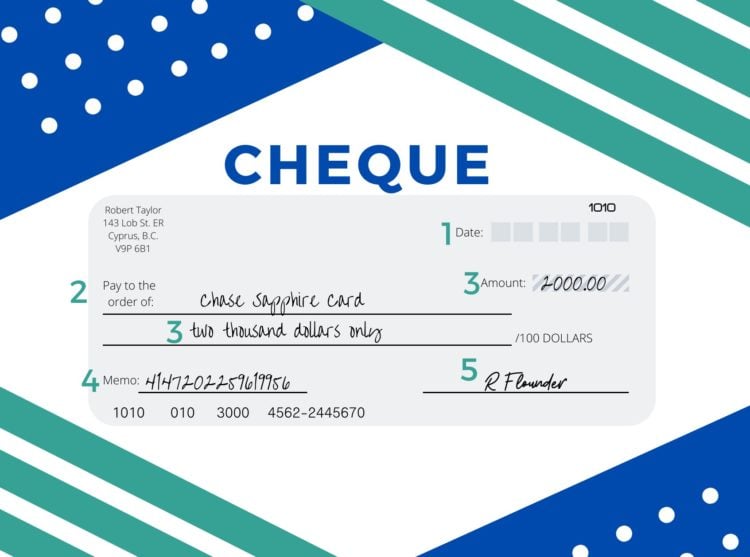

When writing a cheque, it’s recommended that all the sections be filled out. The sections below will walk through how to fill out each section of the cheque.

1: Date

The date written on a cheque will impact whether the payee can cash the cheque. If the cheque is dated for today, then the payee can cash the cheque immediately.

Cheques dated for a future date are called post-dated cheques. They are commonly used in scenarios where the payee is meant to cash the cheque at a future date. E.g. monthly rent. Payors should note there is nothing legally binding about the date on a cheque. The date can be a note to the payee to let them know that the funds are not available until that date. Technically, the payee can cash the cheque earlier than the future date.

Most banks will not cash a cheque until the stated date, though occasionally some slip through. Therefore, it is important to ensure you always have the funds available to avoid overdraft and or bounced cheque fees.

2: Payee

The payee is the person or entity that the cheque is made to; they are the person who can cash the cheque. Always double check the name of the person or organization the cheque needs to be made out to. Any incorrect spelling or names will prevent the payee from being able to cash the cheque.

3: Amount

There are two places for the amount to be written on a cheque. One represents the numeric form while the other is the written form. Filling both sections out will minimize the risk of fraud.

In the amount box, write the numbers so that the first digit is up against the left side of the box. This will prevent anyone from adding a number to the beginning of the amount. You can also put a dollar sign to prevent someone to adding a digit in front.

Always include the cents regardless if it is a whole amount. E.g. $2000 should be written as $2000.00. By doing so, you can ensure that no additional amounts are added to the end of the number.

Write out the amount in word form and include any cents. This, again, is to reduce any fraudulent transactions. Bank tellers will typically refuse to cash a cheque where the written and numeric amount do not match.

4: Memo

The memo section is not required but it is commonly used to record what the cheque is for. For example, if the cheque is for an outstanding phone bill, including the invoice number in the memo will ensure that the payment is applied against the correct outstanding balance.

5: Signature

Cheques are only valid when they are signed. The payor’s signature should match the one on file with the bank account.

Other questions about writing a cheque

Mistakes – if you make a mistake on your cheque, simply strike it out and initial next to the mistake.

Stolen cheques – if you know or suspect that your cheques have been stolen for fraudulent use, contact your financial institution immediately to report the incident. They can prevent the cheques from being used and or put a stop payment to cheques that have been issued.

Endorsing a cheque – endorsing a cheque will allow a person other than the payee to cash the cheque. Payees can endorse a cheque by signing the back.

Hold Dates – for larger sums, banks may hold the amount before providing full access. This is done to ensure that there are sufficient funds from the payor.

Stale cheques – typically banks will not cash a cheque that is dated more than 6 months old. There are exceptions to this, such as government cheques. Thus, it is always best to cash your cheque immediately when you receive it. Cheques can be conveniently cashed through an ATM or on your mobile device.