Key takeaways

- (UPDATE) As of May 4, 2021, the PPP Loan fund ran out of money. Therefore, new applications for PPP Loans are no longer being accepted by the SBA.

- The PPP Loan Program provides small businesses with funds for expenses, such as payroll, utilities, and rent or lease payments.

- Ensure that all financial transactions, both revenues and expenditures, are documented accordingly in the case you are asked to provide these details.

- Always check the SBA’s website regularly for updates and or changes to the PPP program.

What is the PPP Loan?

The Paycheck Protection Program is a government initiative that provides support to small businesses in the form of funds. The program began in response to the adversity that COVID placed small businesses under. The primary purpose is to keep as many workers employed as possible.

The program is funded by the CARES Act and is divided into two draws. These draws are the first and second draws. Businesses can receive up to 3.5x their 2019 and 2020 payroll costs through the program.

Businesses interested in applying can do so through the SBA Lender Match tool.

What can a PPP loan be used for?

PPP Loans can only be used for certain expenses. At a minimum, 60% of the funds must be used for payroll expenses and employee benefit costs. This means paying for employees’ salaries, bonuses, commissions, and health insurance premiums. The maximum cap is for an expense per employee is $100,000 annually.

Other expenses that the loan can be used for include:

- Rent or lease payments

- Electric, hydro, and or other utilities

- Property damage

- Cost of goods sold

By using the funds for appropriate items, businesses can later apply to have the loan forgiven. During the application process, you will be asked to certify that the funds will be spent on eligible items. Those who do not spend the funds on these items can be charged with fraud.

Who qualifies for the PPP Loan?

Small businesses are not the only types of businesses that qualify for the PPP Loan. Sole proprietorships, self-employed individuals, and independent contractors are also eligible for the PPP Loan. These groups will need to provide additional information, such as Schedule C, payroll tax filings, and or 1099-NEC documents, to demonstrate their status and qualify for the loan.

Another qualification, which was introduced for the second draw PPP loans, is a reduction in revenue. Businesses that want to apply for the second draw must demonstrate a 25% reduction in revenues. The comparison should be made for the same quarter from 2020 and 2019.

Example of revenue reduction

Year Q1 Q2 Q3 Q4

2019 $10K $15K $15K $20K

2020 $15K $2K $2K $8K

When calculating a revenue reduction, the period that we are comparing between is Q1 in 2020 to Q1 in 2019. In the example above, because the company’s revenues increased during this period, they would not qualify for PPP Loan.

However, if we are comparing revenues between Q2 2020 and Q2 2019, we can see that the business experienced a significant decrease in revenues. In fact, the company’s revenues decrease by more than 25%. Thus, the business would be eligible for a PPP Loan.

Terms of the PPP Loan

Below are the key terms of the loan:

- The maximum amount is the average monthly payroll cost in 2019, 2020 multiplied by 2.5 with a cap of $2 million

- The maturity of the loan is two years at an interest rate of 1%

- The loans cover expenses up to 24 weeks from the date of the loan is disbursed

- Loan payments begin either 10 months after the 24 week coverage period or until the loan is forgiven

- No fees

- No collateral and or personal guarantees required

What is PPP Loan Forgiveness

Businesses can now apply to have their PPP Loan forgiven. This means that the business will not have to repay the loan. Instead, the loan turns into a non-taxable grant.

In order for the PPP Loan to be forgiven, businesses will need to demonstrate they meet the qualifying conditions. These qualifying conditions are meant to ensure that the program achieves its goal, which is to protect paychecks. This means maintaining an average number of full-time employees equal to or greater than your previous year’s average. Also, all funds that you are requesting to be forgiven must be used before applying.

Note: it is best practice to ensure that you are documenting all your expenditures accordingly, as you may be asked to provide these details to your lender.

Who qualifies for PPP Loan Forgiveness?

Businesses can qualify for both first and second draw PPP Loan forgiveness as long as they conduct the following during the 8 – 24 week coverage period:

- Keep employees and compensation levels

- Funds are spent on eligible payroll costs and expenses

- At least 60% of funds are spent on payroll costs

How to apply for loan forgiveness

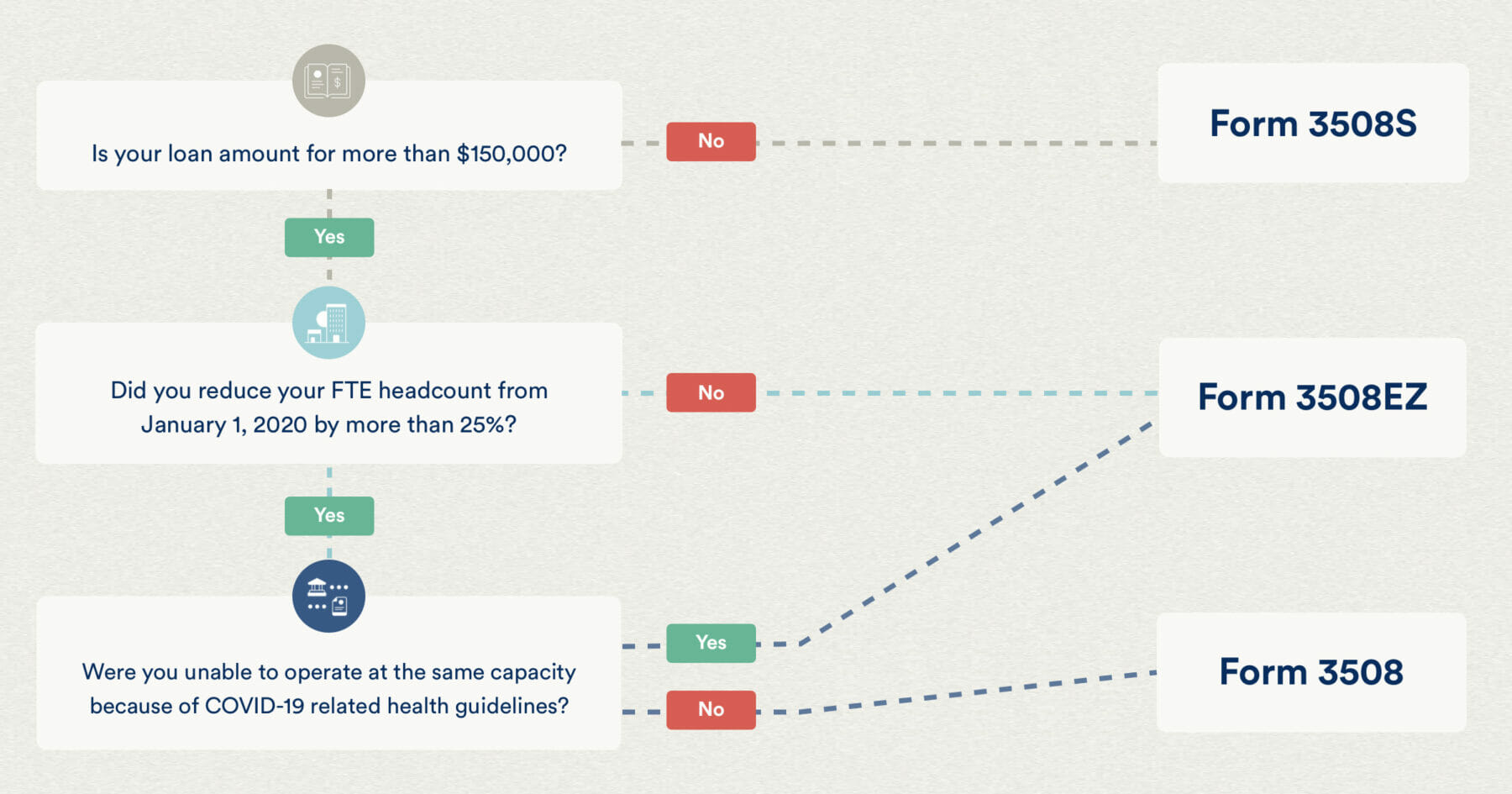

Those who qualify for loan forgiveness can apply through their lenders by completing a form. The form the business completes depends on the loan amount and reduction in headcount. For businesses with a loan amount less than $150K, they can complete a Form 3508S. For businesses with loan amounts of $150K and greater, you will complete either a Form 3508EZ or Form 3508 depending on your full-time employee headcount.

Additionally, borrowers will have up until the maturity date of the loan to apply for loan forgiveness. Some lenders will have online portals that allow you to submit your forgiveness application online. Lenders will typically make a decision within 60 days of your application. For a list of vendors providing forgiveness, check this Bench.co article.

When applying for loan forgiveness, be sure to provide both proofs of your expenses and headcount. This includes any copies of bank statements, utility bills, receipts of key expenses, and payroll checks and records. It is also recommended to prepare the calculate of the average monthly full-time employees for the covered period.

Approval Process

Lenders will typically take 60 days to make a decision on your application. Lenders can either fully approve, partially approve, or fully deny. From there, they will submit the decision to the SBA. The SBA will have 90 days to evaluate the application. If you do not agree with the lender’s decision, you appeal to the SBA.

Related Readings

Professional Leadership Institute (PLI) is an educational website providing professionals from all types of businesses with practical education in entrepreneurial leadership. To keep evolving your leadership toolkit, additional PLI resources below will be useful: