Note: Information contained in this article is not and should not be taken as professional accounting advice. Please consult a chartered professional accountant for the most up to date accounting practices.

What is a subsequent event

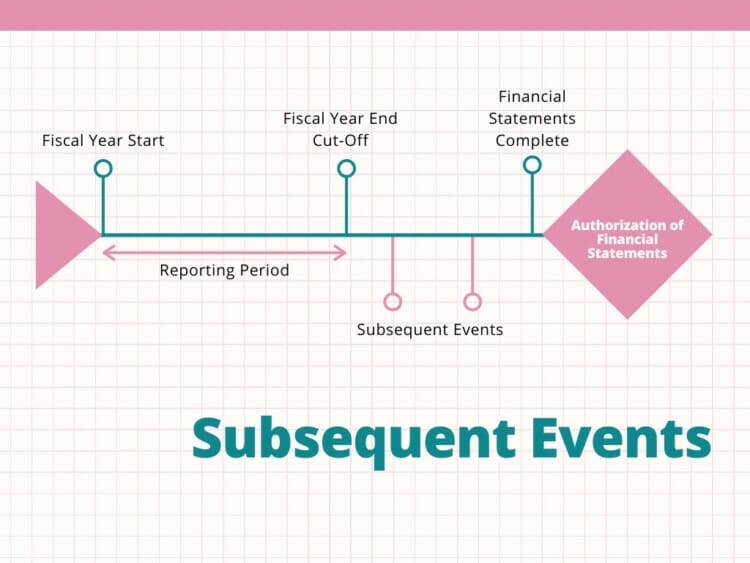

A subsequent event is an event that occurs after the cut-off date for a company’s year end and before the issuance of the financial statements. Depending on the nature of the event, a company may need to disclose the subsequent event and its impact on their financial statements.

Both the IFRS and GAAP have similar rules on how to handle subsequent events. For IFRS, the subsequent event is covered under IAS10. For US GAAP, it is covered under ASC855.

Key takeaways

- Subsequent events occur after the cut-off date and before the authorization and issuance of financial statements

- Disclosing subsequent events on financial statements is important in providing investors with an accurate picture of the company’s financial position

- There are two types of subsequent events

- Adjusting events: provides additional information about an existing condition on the financial statements

- Non-adjusting events: provides new information that is not linked to any condition on the financial statements

Financial statements and subsequent events

The purpose of financial statements is to demonstrate the financial position of a company as of a specific date for a specific time period. Financial statements communicate important information about the business so that leadership and investors can make decisions. These financial statements include the balance sheet, income statement, and cash flow statement, and may be prepared monthly, quarterly, and annually. Public companies are required to file their financial statements quarterly and annually so that investors can access the information.

Financial statements take time to prepare. As a result, there is a gap between when the cut-off of the fiscal year is and when financial statements are released. Businesses still operate during this time and with that transactions may still take place. This gap in time creates an opportunity for subsequent events to occur.

Generally Accepted Account Principles (GAAP) requires the disclosure of all subsequent events that have a material impact on the company’s financial position. This ensures that investors are made aware of any financial events or transactions that have an impact on the business and provides an honest financial picture of the business.

The 2 types of subsequent events

While all subsequent events should be reported, not all of them are formally recognized and baked into the financial statements. The two types of subsequent events are:

- Adjusting (recognized) event – events that provide additional information about an existing condition on the balance sheet. Due to the relationship that additional information has with existing items on the financial statements, an adjusting event will require postings to the financial statements to reflect the subsequent event.

- Non-adjusting (non-recognized) events – events that provide new information about a condition that does not currently exist on the balance sheet. Because this is new information, there is no place on the financial statements that would need to be adjusted. Instead a disclosure within the financial statements is used to communicate the event to investors.

Example of Adjusting Event

An example of a subsequent event that is an adjusting event is the settlement of a lawsuit that happened before the balance sheet date. The company would have assessed an amount for contingent losses pending the lawsuit. Once the lawsuit settles, they would adjust the contingent amount to match the actual losses.

Other examples of adjusting events include client going bankrupt, triggering the need to write off bad debt, and or even detection of fraudulent or erroneous accounting statements.

Example of Non-Adjusting Event

A subsequent event that is a non-adjusting event would be if the company acquires another business. There would be no conditions on the existing financial statements to indicates that a purchase was looming in the future, and thus no adjustment to the financial statements is necessary. Instead, a disclosure of the subsequent event as a footnote in their financial statements is used. This ensures that such events with material impact on the financial position of the company are disclosed to investors.

Other examples of non-adjusting events include losses suffered from a natural disaster or a new lawsuit.